Space Camera Market Size & Trends

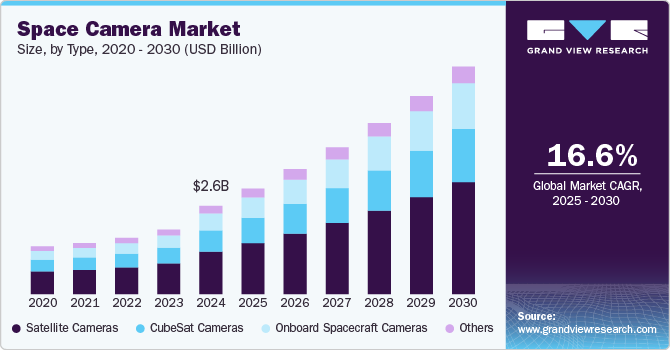

The space camera market size was estimated at USD 2.60 billion in 2024 and is projected to grow at a CAGR of 16.6% from 2025 to 2030. The market is experiencing robust growth, driven by advancements in satellite imaging, deep-space exploration, and Earth observation technologies. The rising demand for high-resolution imaging across sectors such as scientific research, defense, and commercial applications is a key factor fueling expansion. Governments and private space companies, including NASA, ESA, and SpaceX, are investing in next-generation imaging technologies to enhance planetary exploration, space station monitoring, and satellite-based data analytics.

In addition, the rapid deployment of small satellites and CubeSats has accelerated the need for lightweight, high-performance cameras equipped with advanced sensors, enabling real-time imaging and improved operational efficiency in space.

The space camera industry plays a crucial role in advancing human and robotic exploration beyond Earth. High-resolution space cameras are essential for capturing images of distant celestial bodies, studying exoplanets, and supporting lunar and Martian missions. As space exploration accelerates, the demand for advanced imaging systems capable of withstanding harsh environments continues to grow. Future missions to the Moon, Mars, and beyond will rely on cutting-edge space cameras to deliver valuable scientific data, highlighting the ongoing innovation in space imaging technologies.

The rising interest in space tourism and lunar missions is also driving the development of ultra-durable, radiation-resistant imaging systems. Emerging technologies, such as AI-powered image processing and real-time data transmission, are transforming the industry by improving accuracy and operational efficiency. As competition among space-tech companies intensifies, advancements in sensor technology, miniaturization, and cost-effective production will continue to shape market growth through 2030.

Beyond exploration, the defense and intelligence sectors are increasingly utilizing high-resolution space cameras for surveillance and reconnaissance. These imaging systems are being deployed to monitor geopolitical activities, enhance border security, and enable early threat detection. Governments and military organizations are heavily investing in advanced imaging satellites to bolster national security, making real-time intelligence gathering through space cameras a critical asset. This trend is expected to drive further R&D in space-based surveillance technologies.

The adoption of 3D imaging and LiDAR technologies is also expanding within the space camera industry. These innovations enable accurate topographic mapping, asteroid surface analysis, and spacecraft navigation. 3D imaging systems provide essential depth perception for autonomous landing and rover missions, while LiDAR-equipped space cameras offer precise distance measurement and terrain mapping capabilities. As these technologies continue to evolve, they are becoming indispensable for scientific research and planetary reconnaissance.

One of the most critical challenges in space camera design is radiation resistance. Prolonged exposure to cosmic radiation can degrade camera sensors and reduce image quality. To address this, manufacturers are developing radiation-hardened sensors and advanced shielding techniques to enhance camera durability. These innovations are crucial for long-duration missions, including Mars exploration and deep-space probes, ensuring sustained performance in extreme space environments.

The industry is also embracing artificial intelligence (AI) to enhance image processing and data analysis. AI-powered space cameras can autonomously detect anomalies, identify objects, and filter out redundant data before transmission, significantly reducing bandwidth usage and improving real-time decision-making. These AI-driven analytics are particularly valuable for deep-space exploration and military surveillance, optimizing the efficiency and functionality of space imaging systems.

Application Insights

The Earth observation and remote sensing segment held the largest revenue share of over 35% in 2024, driven by the growing need for high-precision satellite imagery across multiple industries. Governments, defense organizations, and private enterprises are increasingly utilizing satellite-based imaging for applications such as environmental monitoring, disaster response, agricultural planning, and urban development. Advances in hyperspectral and multispectral imaging, along with AI-driven analytics, are enhancing data accuracy and usability. In addition, real-time Earth observation solutions are being explored to improve climate tracking, security operations, and resource management. The future of this segment is expected to be shaped by expanding small satellite constellations, ensuring continuous global coverage and faster data transmission for real-time decision-making.

The space tourism and entertainment segment is projected to grow at a CAGR of 17.1% from 2025 to 2030, driven by increasing interest in commercial space travel and luxury orbital experiences. The development of space hotels and entertainment hubs is gaining momentum, with projects like Orbital Assembly Corporation’s Voyager Station aiming to offer premium accommodation in low Earth orbit (LEO). These initiatives are supported by advancements in space station technology and modular habitat construction, making sustained human presence in space more feasible. Companies are also exploring zero-gravity sports, live performances, and immersive cinematic experiences as potential attractions. The long-term vision for space tourism includes extended stays, scientific research opportunities, and commercial filming ventures, paving the way for a new era of entertainment beyond Earth.

Type Insights

The satellite cameras segment held the largest market share in 2024, driven by advancements in imaging technologies beyond traditional electro-optical sensors. The adoption of multispectral and hyperspectral imaging is expanding, offering enhanced capabilities for applications in agriculture, forestry, and mineral exploration. These technologies enable precise analysis of vegetation health and resource deposits, while hyperspectral cameras can identify materials based on their unique spectral signatures, making them valuable for defense and security applications. Several startups and space agencies are actively working on miniaturizing hyperspectral sensors for integration into small satellites and CubeSats. As technology matures and costs decline, multispectral and hyperspectral imaging will become increasingly accessible to commercial users, further driving adoption.

The CubeSat cameras segment is expected to witness the fastest CAGR from 2025 to 2030, fueled by their affordability and ease of deployment for Earth observation. Governments, research institutions, and private enterprises are leveraging CubeSat cameras for climate monitoring, disaster response, and agricultural assessments. The ability to deploy CubeSat constellations provides frequent revisits over target areas, enhancing data collection and enabling real-time analytics. This trend is accelerating investments in miniaturized, high-resolution imaging technologies, strengthening the role of small satellite platforms in Earth observation and remote sensing applications.

Technology Insights

The electro-optical (EO) cameras segment held the largest market share in 2024, driven by increasing demand for high-resolution imaging in environmental monitoring, disaster response, and urban planning. Governments and commercial enterprises are investing in satellites equipped with advanced EO sensors to capture detailed images of Earth’s surface. Higher spatial resolution and enhanced image processing capabilities are enabling more precise analysis and decision-making. This trend is fueling technological advancements in sensor miniaturization and AI-powered onboard image enhancement, improving both efficiency and performance.

The hyperspectral cameras segment is expected to experience the fastest CAGR from 2025 to 2030, as these cameras become integral to defense and security applications, including surveillance, target detection, and threat identification. Their ability to detect concealed objects and distinguish materials based on unique spectral signatures significantly enhances reconnaissance and intelligence operations. Defense agencies are increasingly integrating hyperspectral sensors into satellites, UAVs, and ground-based systems to improve situational awareness. As geopolitical tensions escalate, investments in hyperspectral imaging for defense applications continue to rise, reinforcing its role in next-generation security and surveillance technologies.

End Use Insights

The government and military segment held the largest market share in 2024, driven by the growing adoption of AI-driven analytics in satellite imaging. Machine learning algorithms are being utilized for automated target detection, pattern recognition, and anomaly identification, significantly reducing the time required for intelligence analysis. These advancements enhance military decision-making capabilities by providing real-time, data-driven insights. The integration of AI with high-resolution cameras is expected to further improve the accuracy and efficiency of space-based defense operations, reinforcing its critical role in national security strategies.

The commercial enterprises segment is projected to register the fastest CAGR from 2025 to 2030, fueled by the increasing integration of space-based imaging with Internet of Things (IoT) networks. This convergence enables real-time data collection across industries such as transportation, maritime, and smart cities, enhancing monitoring capabilities for remote locations, disaster response, and infrastructure development. Telecommunications firms are collaborating with satellite imaging providers to expand network coverage and optimize infrastructure management. As IoT adoption accelerates, commercial enterprises are increasingly leveraging satellite-based visual data to enhance operational efficiency and strategic planning.

Regional Insights

The space camera market in North America generated the highest revenue share globally, accounting for over 39% in 2024. This share is attributed to the region’s advancements in space-based imaging, driven by strong investments from both government and private sectors. The demand for high-resolution Earth observation, defense surveillance, and space tourism imaging is fueling growth in satellite and onboard spacecraft cameras. Companies in the U.S. and Canada are collaborating with space agencies and commercial enterprises to develop AI-powered imaging solutions for enhanced data analysis.

U.S. Space Camera Trends

The U.S. space camera industry held a dominant position in the North American region in 2024. The U.S. remains a dominant player, with NASA, the Department of Defense, and private companies investing in advanced imaging technologies. AI and machine learning integration in satellite imaging is improving real-time data processing and decision-making. The increasing deployment of CubeSats and small satellites with high-resolution cameras is expanding the accessibility of space-based imaging solutions.

Europe Space Camera Market Trends

The Europe space camera industry was identified as a lucrative region in 2024. Europe is heavily investing in space imaging for climate monitoring, disaster management, and infrastructure planning. The European Space Agency (ESA) and private companies are developing next-generation optical and hyperspectral cameras for enhanced remote sensing. Collaborative initiatives between governments and commercial enterprises are fostering innovation in satellite imaging technologies.

The UK space camera industry is emerging as a hub for small satellite imaging, with companies focusing on CubeSats and microsatellites for commercial and defense applications. The country is investing in hyperspectral and multispectral imaging to support agriculture, environmental monitoring, and maritime security. Government funding and private-sector partnerships are accelerating the deployment of advanced space cameras.

The space camera industry in Germany is at the forefront of hyperspectral and infrared space imaging, with applications in climate research, defense, and industrial monitoring. German aerospace firms are developing cutting-edge imaging systems for satellites and deep-space exploration. Government-backed research programs are driving innovations in high-resolution space cameras for scientific and commercial use.

Asia-Pacific Space Camera Market Trends

The Asia Pacific space camera industry is expected to grow at the fastest CAGR of 13.9% from 2025 to 2030. Asia Pacific is witnessing rapid growth in space-based imaging, fueled by increasing investments from both government and private sectors. Countries like China, Japan, and India are expanding their satellite imaging capabilities for Earth observation, disaster response, and environmental monitoring. The rise of commercial space companies in the region is boosting demand for CubeSat and onboard spacecraft cameras.

China space camera industry is developing advanced high-resolution and hyperspectral imaging systems for military, commercial, and scientific applications. The country’s aggressive space exploration initiatives, including lunar and deep-space missions, are driving demand for sophisticated space cameras. Chinese space agencies and private firms are collaborating on AI-driven imaging technologies to enhance data analytics and remote sensing capabilities.

The space camera industry in Japan is focusing on AI-driven space imaging solutions to improve satellite data analysis and automation. The country is investing in lightweight, high-resolution cameras for commercial and scientific missions, including space tourism. Collaborations between Japanese space agencies and private technology firms are driving advancements in satellite imaging and onboard spacecraft cameras.

Key Space Camera Company Insights

Some of the key players operating in the market include Canon and Nikon.

-

Canon has a strong presence in space imaging, supplying high-resolution cameras for Earth observation and deep-space missions. The company has collaborated with JAXA and NASA, contributing imaging technology to various satellite and space probe missions. Its advanced optical sensors are known for durability and precision, essential for capturing celestial events. Canon continues to refine its space-grade imaging solutions, leveraging its expertise in sensor miniaturization and AI-enhanced image processing.

-

Nikon has played a key role in space imaging, with its cameras used on the International Space Station (ISS) and in lunar missions. The deployment of the Nikon Z 9 on the ISS in 2024 highlights its growing influence in space photography. Through its Space Act Agreement with NASA, Nikon is developing a modified version of the Z 9 for the Artemis III lunar mission. The company’s advancements in high-resolution, radiation-resistant imaging technology solidify its reputation in space exploration.

KAIROSPACE Co., Ltd. and Micro-Cameras & Space Exploration are some of the emerging participants in the space camera industry.

-

Micro-Cameras & Space Exploration focuses on compact, high-performance cameras for deep-space and planetary exploration. The company has contributed imaging systems to ESA’s Mars and asteroid missions, emphasizing miniaturization and rugged design. Its space-grade cameras are designed to withstand harsh radiation and extreme temperature variations in deep space. With growing interest in interplanetary exploration, Micro-Cameras & Space Exploration is positioned as a key player in next-generation space imaging.

-

KAIROSPACE Co., Ltd. is an emerging player developing innovative optical systems for space applications. The company specializes in high-durability imaging solutions for satellite-based Earth monitoring and astronomical research. Its recent advancements in AI-driven image enhancement have improved data quality for remote sensing applications. KAIROSPACE is expanding its presence through partnerships with aerospace agencies and commercial satellite operators.

Key Space Camera Companies:

The following are the leading companies in the space camera market. These companies collectively hold the largest market share and dictate industry trends.

- Canon

- Hasselblad

- Leica

- Nikon

- Micro-Cameras & Space Exploration

- Malin Space Science Systems

- Dragonfly Aerospace

- Sode

- Pentax

- KAIROSPACE Co., Ltd.

Recent Developments

-

In January 2025, Canadensys Aerospace announced the launch of its lunar-hardened camera aboard the Firefly Blue Ghost Mission 1. This mission is designed to monitor the Honeybee Robotics Lunar PlanetVac system, which collects lunar regolith samples for analysis. The deployment of this camera underscores Canadensys Aerospace’s commitment to developing robust imaging solutions for lunar exploration.

-

In February 2024, Nikon entered into a Space Act Agreement with NASA to support the Artemis III mission, scheduled for September 2026. As part of this collaboration, the Nikon Z 9 will be integrated into NASA’s Handheld Universal Lunar Camera (HULC) system. Nikon engineers are working closely with NASA to modify the camera’s circuitry and firmware, ensuring it can withstand the Moon’s extreme environmental conditions, including temperature fluctuations and cosmic radiation.

-

In January 2024, Nikon’s flagship mirrorless camera, the Z 9, was deployed to the International Space Station (ISS) to assist NASA astronauts in capturing high-quality images of Earth and space. This deployment included multiple Z 9 camera bodies and a selection of NIKKOR Z lenses, replacing the previously used Nikon D6 and D5 DSLR cameras. Notably, the Z 9 cameras remained physically unmodified, demonstrating their durability and suitability for the challenging conditions of space.

Space Camera Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 3.10 billion

|

|

Revenue forecast in 2030

|

USD 6.70 billion

|

|

Growth rate

|

CAGR of 16.6% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 – 2023

|

|

Forecast period

|

2025 – 2030

|

|

Quantitative units

|

Revenue in USD billion/million, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Component, capacity, refrigerant, application, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, China, Australia, Japan, India, South Korea, Brazil, Saudi Arabia, UAE, South Africa

|

|

Key companies profiled

|

Canon, Hasselblad, Leica, Nikon, Micro-Cameras & Space Exploration, Malin Space Science Systems, Dragonfly Aerospace, Sode, Pentax, KAIROSPACE Co., Ltd.

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Space Camera Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global space camera market report based on application, type, technology, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 – 2030)

-

Space Exploration

-

Earth Observation and Remote Sensing

-

Astronomy and Cosmic Studies

-

Space Tourism and Entertainment

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 – 2030)

-

Technology Outlook (Revenue, USD Million, 2018 – 2030)

-

End Use Outlook (Revenue, USD Million, 2018 – 2030)

-

Government and Military

-

Commercial Enterprises

-

Space Agencies

-

Research Institutions

-

-

Regional Outlook (Revenue, USD Million, 2018 – 2030)

-

North America

-

Europe

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global space camera market size was estimated at USD 2.60 billion in 2024 and is expected to reach USD 3.10 billion in 2025

b. The global space camera market is expected to grow at a compound annual growth rate of 16.6% from 2025 to 2030 to reach USD 6.70 billion by 2030.

b. North America dominated the space camera market with a share of over 39% in 2024. North America advancements in space-based imaging, driven by strong investments from both government and private sectors. The demand for high-resolution Earth observation, defense surveillance, and space tourism imaging is fueling growth in satellite and onboard spacecraft cameras.

b. Some key players operating in the space camera market include The demand for high-resolution Earth observation, defense surveillance, and space tourism imaging is fueling growth in satellite and onboard spacecraft cameras

Canon, Hasselblad, Leica, Nikon, Micro-Cameras & Space Exploration, Malin Space Science Systems, Dragonfly Aerospace, Sode, Pentax, KAIROSPACE Co., Ltd.

b. Key factors that are driving the market growth include increasing space exploration missions, technological advancements in camera sensors, and rising demand for Earth observation.

link